The deadline to file your 2023 federal income taxes is April 15. Here are some resources to help you complete your tax forms:

TurboTax Discount

NC State employees who use TurboTax to e-file their taxes can get a discount of up to $20 on TurboTax’s e-file products. The TurboTax discount is available to employees through the NC State Faculty and Staff Assistance Program. ComPsych, a provider of employee assistance programs, manages our FASAP program.

To get that discount, you’ll need to go to ComPsych’s website and log in. If you have never logged into the ComPsych site before, you will need to register to use it. To register, use this web ID: FASAP.

After you log in, scroll down until you see the Discounts tile, and then click it. Look for the TurboTax tile, and follow the instructions provided.

Income Tax Filing Tips

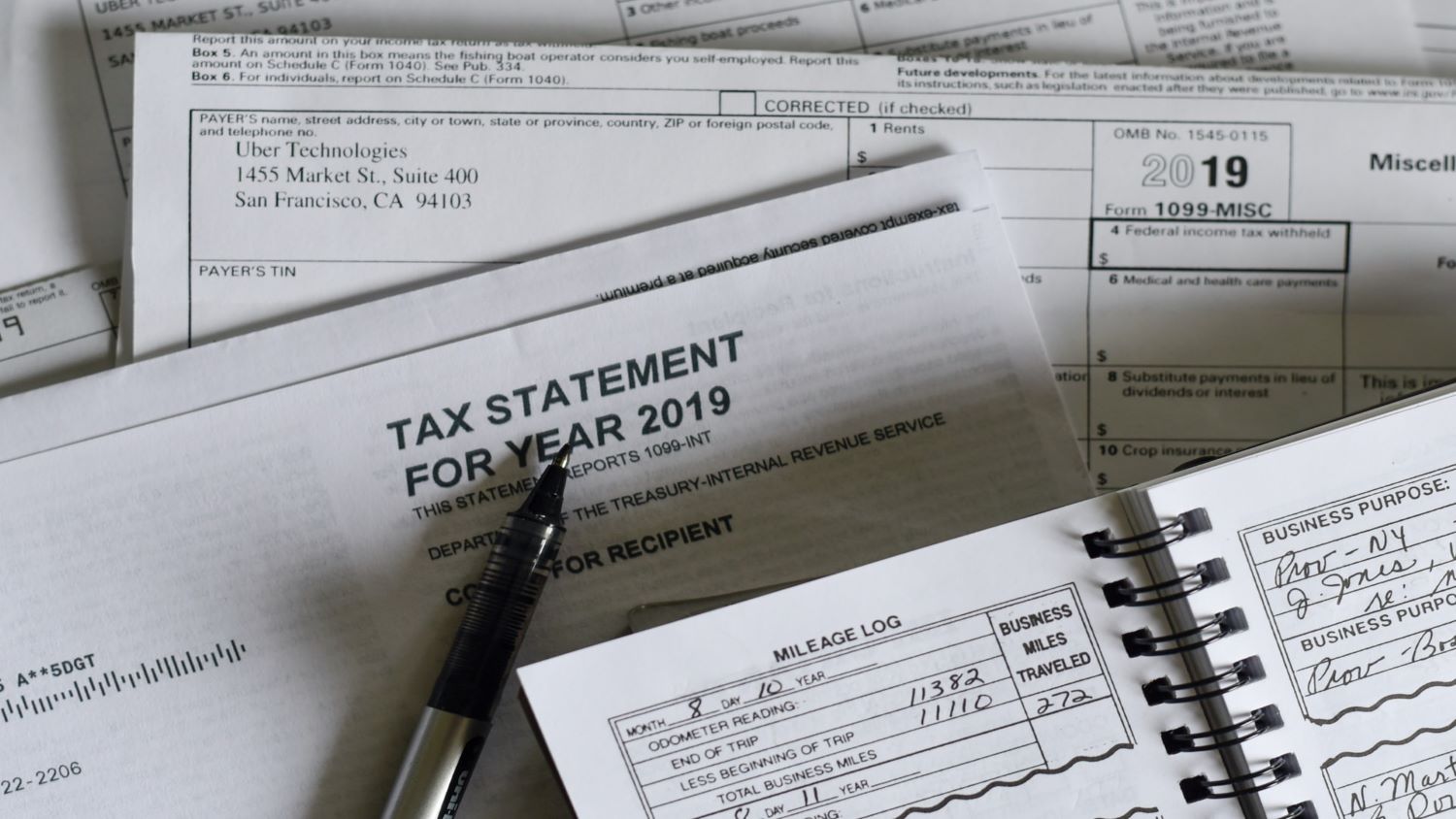

Filing a federal tax return can be a tedious and time-consuming task, so it’s never too early to start preparing. Here are some filing tips from FASAP:

- Get started now.

- Organize receipts, paycheck stubs, financial records, mortgage statements and other important documents, and try to estimate how much you will owe or be refunded. Schedule enough time to complete your return and avoid the filing deadline rush.

- Educate yourself.

- Learn about the latest tax laws so you can take advantage of as many deductions, exemptions and credits as possible. Visit the IRS website or call the IRS toll-free at 800-829-1040 for help. Consider hiring a certified public account, financial planner or tax attorney for help with a complex tax return.

- Understand your payment options.

- There are alternatives if you cannot immediately pay the taxes you owe. You can apply for an installment agreement on the IRS website, and there are options for charging the balance on a credit card. The IRS won’t tack on a fee for credit card payments, but the processing companies will charge a convenience fee.

- File your taxes by the deadline.

- If can’t file your taxes on time, you can submit IRS Form 4868 — Application for Automatic Extension of Time to File U.S. Individual Income Tax Return — and receive an automatic six-month extension to postpone your filing date. This pushes back the due date for the paperwork. It doesn’t give you more time to pay any taxes due, so you will owe interest on any amount not paid by the May 17 deadline, plus a late payment penalty if you have not paid at least 90 percent of your total tax by that date

- Categories: